Stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a significant cross-section of a stock market. Crashes are driven by panic as much as by underlying economic factors. They often follow speculative stock market bubbles.

Stock market crashes are social phenomena where external economic events combine with crowd behavior and psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions[citation needed]: a prolonged period of rising stock prices and excessive economic optimism, a market where Price to Earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants.

There is no numerically specific definition of a crash but the term commonly applies to steep double-digit percentage losses in a stock market index over a period of several days. Crashes are often distinguished from bear markets by panic selling and abrupt, dramatic price declines. Bear markets are periods of declining stock market prices that are measured in months or years. While crashes are often associated with bear markets, they do not necessarily go hand in hand. The crash of 1987 for example did not lead to a bear market. Likewise, the Japanese Nikkei bear market of the 1990s occurred over several years without any notable crashes।

Wall Street Crash of 1929

The most famous crash, the Wall Street Crash of 1929, happened on October 29, 1929. The economy had been growing robustly for most of the so-called Roaring Twenties. It was a technological golden age as innovations such as radio, automobiles, aviation, telephone and the power grid were deployed and adopted. Companies who had pioneered these advances like Radio Corporation of America (RCA), and General Motors saw their stocks soar. Financial corporations also did well as Wall Street bankers floated mutual fund companies (then known as investment trusts) like the Goldman Sachs Trading Corporation. Investors were infatuated with the returns available in the stock market especially with the use of leverage through margin debt. On August 24, 1921, the Dow Jones Industrial Average stood at a value of 63.9. By September 3, 1929, it had risen more than sixfold, touching 381.2. It would not regain this level for another twenty five years. By the summer of 1929, it was clear that the economy was contracting and the stock market went through a series of unsettling price declines. These declines fed investor anxiety and events soon came to a head. October 24 (known as Black Thursday) was the first in a number of increasingly shocking market drops. This was followed swiftly by Black Monday on October 28 and Black Tuesday on October 29.

On Black Tuesday, the Dow Jones Industrial Average fell 38 points to 260, a drop of 12.8%. The deluge of selling overwhelmed the ticker tape system that normally gave investors the current prices of their shares. Telephone lines and telegraphs were clogged and were unable to cope. This information vacuum only led to more fear and panic. The technology of the New Era, much celebrated by investors previously, now served to deepen their suffering.

Black Tuesday was a day of chaos. Forced to liquidate their stocks because of margin calls, overextended investors flooded the exchange with sell orders. The glamour stocks of the age saw their values plummet. Across the two days, the Dow Jones Industrial Average fell 23%.

By the end of the week of November 11, the index stood at 228, a cumulative drop of 40 percent from the September high. The markets rallied in succeeding months but it would be a false recovery that led unsuspecting investors into the worst economic crisis of modern times. The Dow Jones Industrial Average would lose 89% of its value before finally bottoming out in July 1932.

While the Crash may have inflicted heavy financial loss on many investors, Main Street was far less involved in the stock market than it is today, and the crash alone cannot be blamed for the Great Depression which followed. The Crash dealt a severe blow to many a stockholder's portfolio, but the main cause of the Depression was the federal government's raising tariffs and severely resticting the money supply, which significantly curtailed economic activity across the board and prolonged the recovery. Many essential sectors recovered fairly quickly, but few buyers had much cash, and those who did were reluctant to spend it.

The Crash of 1987

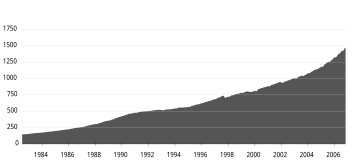

The mid-1980s were a time of strong economic optimism. From August 1982 to its peak in August 1987, the Dow Jones Industrial Average (DJIA) grew from 776 to 2722. The rise in market indices for the 19 largest markets in the world averaged 296 percent during this period. The average number of shares traded on the NYSE had risen from 65 million shares to 181 million shares.[1]

The crash on October 19, 1987, a date that is also known as Black Monday, was the climactic culmination of a market decline that had begun five days before on October 14th. The DJIA fell 3.81 percent on October 14, followed by another 4.60 percent drop on Friday October 16th. But this was nothing compared to what lay ahead when markets opened on the subsequent Monday. On Black Monday, the Dow Jones Industrials Average plummeted 508 points, losing 22.6% of its value in one day. The S&P 500 dropped 20.4%, falling from 282.7 to 225.06. The NASDAQ Composite lost only 11.3% not because of restraint on the part of sellers but because the NASDAQ market system failed. Deluged with sell orders, many stocks on the NYSE faced trading halts and delays. Of the 2,257 NYSE-listed stocks, there were 195 trading delays and halts during the day. [2] The NASDAQ market fared much worse. Because of its reliance on a "market making" system that allowed market makers to withdraw from trading, liquidity in NASDAQ stocks dried up. Trading in many stocks encountered a pathological condition where the bid price for a stock exceeded the ask price. These "locked" conditions severely curtailed trading. On October 19th, trading in Microsoft shares on the NASDAQ lasted a total of 54 minutes.

The Crash was the greatest single-day loss that Wall Street had ever suffered in continuous trading up to that point. Between the start of trading on October 14th to the close on October 19, the DJIA lost 760 points, a decline of over 31 percent.

The 1987 Crash was a worldwide phenomenon. The FTSE 100 Index lost 10.8% on that Monday and a further 12.2% the following day. In the month of October, all major world markets declined substantially. The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of 23 major industrial countries, 19 had a decline greater than 20%.[3]

Despite fears of a repeat of the 1930s Depression, the market rallied immediately after the crash, posting a record one-day gain of 102.27 the very next day and 186.64 points on Thursday October 22. It took only two years for the Dow to recover completely; by September 1989, the market had regained all of the value it had lost in the 1987 crash. The Dow Jones Industrial Average gained six-tenths of a percent during the calendar year 1987.

No definitive conclusions have been reached on the reasons behind the 1987 Crash. Stocks had been in a multi-year bull run and market P/E ratios in the U.S. were above the post-war average. The S&P 500 was trading at 23 times earnings, a postwar high and well above the average of 14.5 times earnings.[4] Herd behavior and psychological feedback loops play a critical part in all stock market crashes but analysts have also tried to look for external triggering events. Aside from the general worries of stock market overvaluation, blame for the collapse has been apportioned to such factors as program trading, portfolio insurance and derivatives, and prior news of worsening economic indicators (i.e. a large U.S. merchandise trade deficit and a falling U.S. dollar which seemed to imply future interest rate hikes).[5]

One of the consequences of the 1987 Crash was the introduction of the circuit breaker or trading curb on the NYSE. Based upon the idea that a cooling off period would help dissipate investor panic, these mandatory market shutdowns are triggered whenever a large pre-defined market decline occurs during the trading day.

Mathematical theory of stock market crashes

The mathematical characterisation of stock market movements has been a subject of intense interest. The conventional assumption that stock markets behave according to a random Gaussian or normal distribution is incorrect. Large movements in prices (i.e. crashes) are much more common than would be predicted in a normal distribution. Research at the Massachusetts Institute of Technology shows that there is evidence that the frequency of stock market crashes follow an inverse cubic power law.[6] This and other studies suggest that stock market crashes are a sign of self-organized criticality in financial markets. In 1963, Benoît Mandelbrot proposed that instead of following a strict random walk, stock price variations executed a Lévy flight.[7] A Lévy flight is a random walk which is occasionally disrupted by large movements. In 1995, Rosario Mantegna and Gene Stanley analyzed a million records of the S&P 500 market index, calculating the returns over a five year period.[8] Their conclusion was that stock market returns are more volatile than a Gaussian distribution but less volatile than a Lévy flight.

Researchers continue to study this theory, particularly using computer simulation of crowd behaviour, and the applicability of models to reproduce crash-like phenomena.